Under the Swedish law, when the parties failed to choose the applicable law, their arbitration agreement is governed by the law of the seat of the arbitration, provided that the parties have specified the seat in their agreement. That much is clear. However, when the parties have not stipulated a seat in their agreement, there is cause for concern. In fact, this interpretation was upheld by scholars: However, although the wording of section 48 supports this interpretation, the wording of the Government Bill that preceded the SAA does not.

These conclusions are, however, not easily made by reading the SAA. The discrepancy between the language of section 48 and the intention of the legislator as expressed in the Government Bill can lead to great ambiguity where international practitioners are not familiar with the often untranslated Swedish preparatory works. The specific requirements or preferences of your reviewing publisher, classroom teacher, institution or organization should be applied.

The E-mail Address es field is required. Please enter recipient e-mail address es. The E-mail Address es you entered is are not in a valid format. Please re-enter recipient e-mail address es. You may send this item to up to five recipients. The name field is required. Please enter your name. The E-mail message field is required. Please enter the message.

International Commercial Arbitration Research Guide

Please verify that you are not a robot. Would you also like to submit a review for this item? You already recently rated this item. Your rating has been recorded. Write a review Rate this item: Preview this item Preview this item. International arbitration in Sweden: The state argued that the cooling-off period for negotiations under Article 26 ECT constituted a jurisdictional requirement that must be fulfilled for a valid arbitration agreement to exist. The majority two out of three of the judges in the Court did not agree, whereas one judge dissented and found in favour of the state in this particular respect.

Find a copy online

However, this does not suffice to finally determine this issue. In the continued analysis, the majority found that there seems to be no uniform case law, nor any uniform position in legal literature, in this respect. Therefore, the majority determined the purpose of the cooling-off period. The conclusion was that the purpose in short, to give the parties an opportunity to amicably resolve the dispute in some instances could be fulfilled even subsequent to the commencement of arbitral proceedings.

Consequently, the majority concluded that the issue of cooling off is not of a jurisdictional nature. The majority's conclusion was therefore that a valid arbitration agreement existed between the parties, and that the arbitral tribunal had jurisdiction in the dispute. In brief, the claim for invalidity of the award due to fraud was based on the allegation that the investors had initiated a fraudulent scheme to deceive the state regarding the amount invested in a liquefied petroleum gas plant.

The fraudulent scheme was claimed to include sham agreements and other means by which the investors had inflated the value of the gas plant and made streams of money flow out of the state into tax havens in the Caribbean. To uphold the arbitral award would thus be in conflict with public policy, according to the state. The Court found that the subject of the dispute in itself i. The Court further noticed that, although the potential existence of forged or false evidence in the arbitral proceedings could be seen as a violation of public policy, the threshold for such determination under Swedish law is very high.

There is no case law in support of such a claim. Without determining whether forged or false evidence in fact was invoked in the arbitral proceedings, the Court concluded that such evidence, in any event, did not directly influence the outcome of the case. From this point of departure, the Court found that, even if forged or false evidence existed, this could not result in the invalidity of the arbitral award in this case.

SICAV claimed that an arbitration agreement existed, and that such proceedings were to be administered by the SCC in accordance with the bilateral investment treaty entered into between Spain and the Soviet Union on 26 October the treaty. An arbitral tribunal was constituted and subsequently decided 17 that, in accordance with Article 10 of the treaty, it had jurisdiction to determine whether Russia had committed expropriation measures against SICAV. In short, SICAV claimed that they had made investments within Russian territory and that such investments were protected by the treaty.

As a result of tax revisions by authorities in Russian, the taxable income for Yukos significantly increased in and Yukos was not capable of paying the additional taxes, and its shareholding in its subsidiary, Yuganskneftegaz, was sequestered and sold on executive auction.

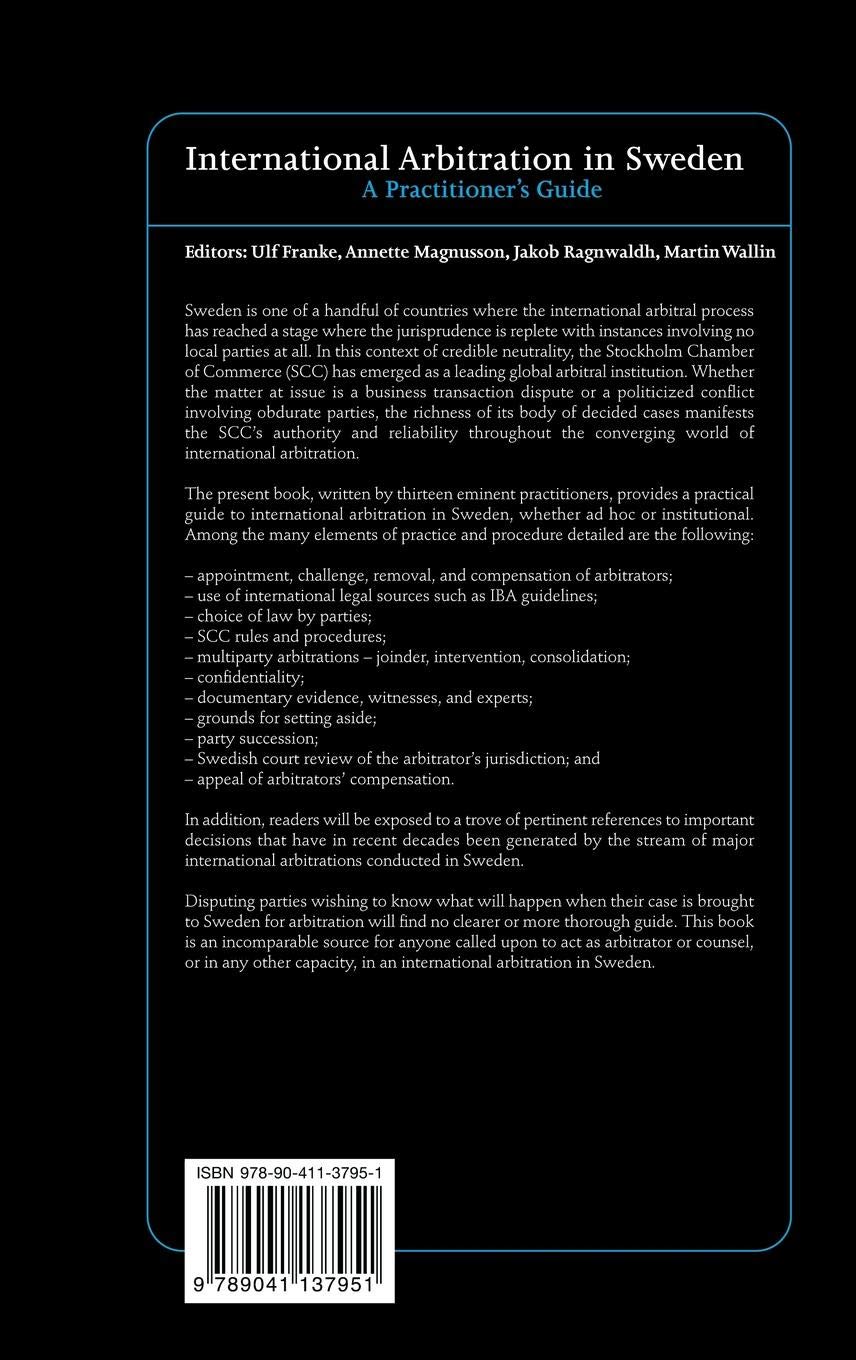

International arbitration in Sweden : a practitioner's guide (Book, ) [theranchhands.com]

Further measures were also taken to enforce the tax decisions, and Yukos was finally declared bankrupt and its remaining assets liquidated. In September , Russia filed a claim with the Stockholm District Court requesting that it was to establish that the arbitral tribunal did not have jurisdiction to determine the dispute initiated by SICAV with a request for arbitration dated 25 March Meanwhile, the arbitration proceedings continued and the arbitral tribunal rendered its award on 20 July The arbitral tribunal found that the actions taken by Russia were expropriation measures, and that SICAV was entitled to reimbursement.

In the case before the district court, Russia claimed that the American depository receipts did not constitute an investment as defined in the treaty, and that in any event the investment had not taken place within Russian territory, both being prerequisites according to Articles 1 and 2 of the Treaty for the determination of what shall be considered an investment. Moreover, Russia claimed that the arbitration clause in the treaty did not provide the arbitral tribunal with jurisdiction to determine whether the invoked actions constituted expropriation measures, and that Russia had not admitted that any expropriation had taken place.

Moreover, contrary to what SICAV had invoked, Russia claimed that Article 5 2 of the treaty, a most favoured nation clause MFN clause , and other investment treaties between Russia and other countries, did not provide grounds for jurisdiction by extending the scope of Article 10 of the treaty.

The judgment was appealed by Russia to the Svea Court of Appeal. The Svea Court of Appeal reversed the judgment of the District Court and ruled in favour of Russia, thus declaring that the arbitral tribunal lacked jurisdiction to determine the dispute with reference to the treaty. The treaty is a bilateral treaty between sovereign states and governed by international law, which does not provide a general obligation for any state to submit to the jurisdiction of an arbitral tribunal. On the contrary, such jurisdiction requires that the relevant state has consented thereto.

Do you want to become a member?

By use of Articles 31 and 32 of the Vienna Convention on the law of treaties, the Court of Appeal interpreted the relevant articles of the treaty and concluded that:. Consequently, the Court of Appeal found that an MFN clause could per se provide an arbitral tribunal with the possibility to determine jurisdiction over a matter by referencing a more favourable dispute resolution mechanism in another investment treaty that has been entered into by the relevant state. However, this would be dependent on the wording of the MFN clause at hand. In this case, it was stated in the MFN clause, Article 5 2 , that each state warranted the fair and equitable treatment of investors from the other state.

The Court of Appeal also concluded that the standard of fair and equitable treatment is one of the cornerstones of current investment law, and shall provide investors protection from serious cases of arbitrary decision-making, discrimination and abuse of the host state. Furthermore, the Court of Appeal concluded that said standard includes the right of judicial review and a fair trial, but it does not provide an unconditional right for an investor to have a dispute tried by an international arbitral tribunal.

As the Court of Appeal found that no jurisdiction existed for the arbitral tribunal, it did not find it necessary to determine whether any arbitration agreement existed between the parties. One of the judges of the Court of Appeal had a dissenting opinion regarding the reasons for the judgment. The dissenting judge was of the opinion that the American Depository Receipts in question did not meet the treaty's definition of an investment, and that SIVAC's request for arbitration did not conform to the offer for arbitration in the treaty.

As a result, the dissenting opinion considered that the request for arbitration did not result in a valid arbitration agreement. Sweden continues to attract a large number of international arbitrations, and hosts a very active arbitration community. Any measures aimed at strengthening the position of Sweden on the international arbitration market are very welcome and supported by the community. The fact that the new SCC Rules and the proposed amendments to the Act have taken the thoughts and ideas of foreign and Swedish practitioners into consideration is very positive.

It remains to be seen what comes of these proposals, but it is fair to say that many of the proposed amendments would be beneficial for Swedish arbitration, in particular from an international perspective.

- Dispute Resolution.

- Find a copy in the library?

- Related products for Journal of International Arbitration - Kluwer Law Online.

- Verification Errors;

- International arbitration in Sweden : a practitioner's guide.

- International Arbitration in Sweden. A Practitioner's Guide.

- Post navigation.

Practice and Procedure, Juris Publishing, Ammouris Kaffe et al. T and T Hence, in his opinion, the provision is a jurisdictional one. However, the dissenting judge found that the investors in fact had fulfilled the requirements for the cooling-off period prior to the request for arbitration and thus that a valid arbitration agreement existed between the parties.

The Acquisition and Leveraged Finance Review. The Banking Regulation Review. The Class Actions Law Review. The Corporate Governance Review.