For instance, in the short term, insurance firms will undoubtedly feel the pinch, with many needing to invest more time and money into efficiently reporting their solvency ratios to the regulators. But there will be a preliminary review of the new directive in when EIOPA will address some of the complexities.

More widely, fears are increasing over the economic reality of low interest rates which are hitting the life insurance market the hardest , decreasing corporate yields, and stock market volatility with Brexit. Although the consequences of Brexit have not been as bad as expected so far, these factors will still need to be managed in the balance sheet. And despite all the difficulties that lie ahead for the industry as a whole, EIOPA stresses that we must remember that the ultimate goal of Solvency II is not just to unify a single EU insurance market, but to increase consumer protection — and adopting a consumer-centered approach is beneficial for all.

In terms of natural catastrophe risk, ensuring capital adequacy and managing an effective risk management framework under Solvency II, requires the use of an internal model and the implementation of sophisticated nat cat models into the process. But what are the benefits of using an internal model and how can integrated cat models help a re insurer assess cat risk under the new regulatory regime?

Under Pillar I of the Directive, insurers are required to calculate their Solvency Capital Requirement SCR , which is used to demonstrate to supervisors, policyholders, and shareholders that they have an adequate level of financial resources to absorb significant losses. Companies have a choice between using the Standard Formula or an internal model or partial internal model when calculating their SCR, with many favoring the use of internal models, despite requiring significant resources and regulatory approval.

Introduction

Internal models are more risk-sensitive and can closely capture the true risk profile of a business by taking risks into account that are not always appropriately covered by the Standard Formula, therefore resulting in reduced capital requirements. Rising insured losses from global natural catastrophes, driven by factors such as economic growth, increasing property values, rising population density, and insurance penetration—often in high risk regions, all demonstrate the value of embedding a cat model into the internal model process.

Due to significant variances in data granularity between the Standard Formula and an internal model, a magnitude of difference can exist between the two approaches when calculating solvency capital, with potentially lower SCR calculations for the cat component when using an internal model. The application of Solvency II is, however, not all about capital estimation, but also relates to effective risk management processes embedded throughout an organization.

Implementing cat models fully into the internal model process, as opposed to just relying only on cat model loss output, can introduce significant improvements to risk management processes. Cat models provide an opportunity to improve exposure data quality and allow model users to fully understand the benefits of complex risk mitigation structures and diversification. Catastrophe model vendors are therefore obliged to help users understand underlying assumptions and their inherent uncertainties, and provide them with the means of justifying model selection and appropriateness.

Insurers have benefited from RMS support to fulfil these requirements, offering model users deep insight into the underlying data, assumptions, and model validation, to ensure they have complete confidence in model strengths and limitations. As always, the risk is particularly uncertain, and with Solvency II due smack in the middle of the season, there is greater imperative to really understand the uncertainty surrounding the peril—and manage windstorm risk actively.

Business can benefit, too: The variability of European windstorm seasons can be seen in the record of the past few years. Though insured losses were moderate[1], had their tracks been different, losses could have been so much more severe. In contrast, was busy. The intense rainfall brought by some storms resulted in significant inland flooding, though wind losses overall were moderate, since most storms matured before hitting the UK.

These two storms were outliers during a general lull of European windstorm activity that has lasted about 20 years. Spiky losses like Niklas could occur any year, and maybe in clusters , so it is no time for complacency. The unpredictable nature of European windstorm activity clashes with the demands of Solvency II , putting increased pressure on re insurance companies to get to grips with model uncertainties.

Under the new regime, they must validate modeled losses using historical loss data. That is simply too little loss information to validate a European windstorm model, especially given the recent lull, which has left the industry with scant recent claims data. That exacerbates the challenge for companies building their own view based only upon their own claims. The model includes the most up-to-date long-term historical wind record, going back 50 years, and incorporates improved spatial correlation of hazard across countries together with a enhanced vulnerability regionalization, which is crucial for risk carriers with regional or pan-European portfolios.

For Solvency II validation, it also includes an additional view based on storm activity in the past 25 years. Windstorm clustering—the tendency for cyclones to arrive one after another, like taxis—is another complication when dealing with Solvency II. It adds to the uncertainties surrounding capital allocations for catastrophic events, especially due to the current lack of detailed understanding of the phenomena and the limited amount of available data.

To chip away at the uncertainty, we have been leading industry discussion on European windstorm clustering risk, collecting new observational datasets, and developing new modeling methods. We plan to present a new view on clustering, backed by scientific publications, in These new insights will inform a forthcoming RMS clustered view, but will be still offered at this stage as an additional view in the model, rather than becoming our reference view of risk. We will continue to research clustering uncertainty, which may lead us to revise our position, should a solid validation of a particular view of risk be achieved.

The scientific community is still learning what drives an active European storm season. Some patterns and correlations are now better understood , but even with powerful analytics and the most complete datasets possible, we still cannot yet forecast season activity. However, our recent model update allows re insurers to maintain an up-to-date view, and to gain a deeper comprehension of the variability and uncertainty of managing this challenging peril.

That knowledge is key not only to meeting the requirements of Solvency II, but also to increasing risk portfolios without attracting the need for additional capital. It can improve a wide range of risk management decisions, from basic geographical risk diversification to more advanced deterministic and probabilistic modeling. The need to capture and use high quality exposure data is not new to insurance veterans. The underlying logic of this principle is echoed in the EU directive Solvency II, which requires firms to have a quantitative understanding of the uncertainties in their catastrophe models; including a thorough understanding of the uncertainties propagated by the data that feeds the models.

The implementation of Solvency II will lead to a better understanding of risk, increasing the resilience and competitiveness of insurance companies. Firms see this, and more insurers are no longer passively reacting to the changes brought about by Solvency II. Increasingly, firms see the changes as an opportunity to proactively implement measures that improve exposure data quality and exposure data management.

And there is good reason for doing so: As a result, many reinsurers apply significant surcharges to cedants that are perceived to have low-quality exposure data and exposure management standards. Conversely, reinsurers are more likely to provide premium credits of 5 to 10 percent or offer additional capacity to cedants that submit high-quality exposure data. Rating agencies and investors also expect more stringent exposure management processes and higher exposure data standards.

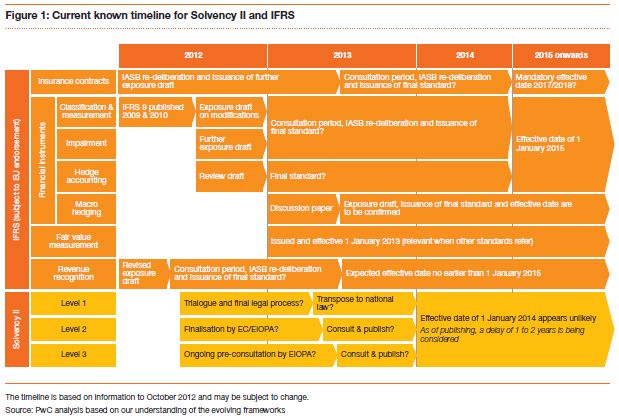

Sound exposure data practices are, therefore, increasingly a priority for senior management, and changes are driven with the mindset of benefiting from the competitive advantage that high-quality exposure data offers. However, managing the quality of exposure data over time can be a challenge: The new solvency requirements have been designed to ensure that insurers have sufficient capital to withstand adverse events, both in terms of insurance risk as under the previous regime , and now also in terms of economic, market and operational risk. Solvency II is to be adopted in accordance with the 'Lamfalussy' process.

The Lamfalussy process takes a four-stage approach to the introduction of financial services regulation. In the first stage a framework directive is proposed after a full consultation process. At stage two technical implementing measures or 'delegated acts' under Omnibus II are introduced; much of the detail is added at this stage.

Solvency II | The RMS Blog

The third stage involves work on recommended guidance and non-binding standards which are not included in the legislation. Finally, the fourth stage of the process requires the European Commission to monitor compliance by Member States. Solvency II will be based on a 'three pillar' framework. The pillar system originates from the approach taken in the Capital Requirements Directive, which followed the international Basel II Accord for banks and investment firms. Under the first pillar insurers are required to maintain reserves against liabilities technical provisions. A consistent market-based system is applied for assessing liabilities as well as ensuring a greater matching of assets to liabilities.

Insurers and reinsurers must adhere to a Minimum Capital Requirement MCR , which is the fundamental level of solvency required of any insurer. If the MCR is breached, supervisory action will be taken. The Solvency Capital Requirement SCR represents the target level of solvency which an insurer or reinsurer needs to maintain. It is a fully risk-based calculation which can be made either through a standard formula or by using internal models or a combination of both. Basically the SCR is the amount of capital needed to leave a less than 1 in chance of capital being inadequate over the forthcoming year.

The Directive requires that insurers and reinsurers invest their assets in accordance with the 'prudent person' principle and they should invest in such a manner as to 'ensure the security, quality, liquidity and profitability of the portfolio as a whole'. Insurers will be required to submit their own assessment of risk and solvency capital adequacy known as the ORSA.

In addition, they must submit details of their internal systems and controls. Should it be seen to be necessary, supervisors may require a 'capital add-on'. It might be that the supervisor will request that further capital be injected into the SCR following the review process, although this should only occur when the supervisory authority concludes that the risk-profile of the insurer 'deviates significantly' from the assumptions underlying the SCR. The third pillar harmonises disclosure requirements.

Insurers are required to report publicly on their financial condition, providing information on capital. In summer , EIOPA published a series of reports in response to consultations launched towards the end of Insurers are expected to have the necessary competence and expertise to find 'fit-for-purpose solutions' for the practical challenges of the ORSA.

EIOPA points out that proportionality is a key feature of the ORSA and insurers should develop tailored processes to fit their own organisational structure and risk management systems. Finally, the report notes that undertakings are required to submit a forward-looking assessment of their overall solvency needs to national supervisory authorities, indicating multi-year tendencies and developments.

EIOPA will revisit each of these reports once the final Level 2 implementing measures have been agreed in order to verify whether any amendments to the criteria change the conclusions reached. At the same time, EIOPA will consider whether any changes made to the Bermudan, Japanese and Swiss solvency and prudential regimes affect the assessments. Once the review is complete the European Commission will decide upon the equivalence of these third countries.

The European Commission has developed a transitional regime for Solvency II equivalence for third countries which either have a risk-based regime similar to Solvency II, or are willing and committed to move towards such a regime over a pre-defined period 5 years in the initial proposal. For those third countries that have indicated that they are interested in being covered by the transitional provisions, the European Commission requested that EIOPA carry out a 'gap analysis'.

EIOPA sent these countries requests for information in order to carry out the analysis. EIOPA's work is of a technical nature only. It will be up to the European Commission to decide which third countries will be included in the equivalence transitional regime. The process is subject to adoption of Omnibus II.

- ;

- Where are we now?.

- Triple Speak.

- EIOPA Solvency II!

- The Evensong!

- ;

There is no definitive date but the Commission is expected to decide on equivalence sometime in A number of UK consultations were published in which considered the rules required to transpose the Solvency II Directive. The FSA launched the second consultation on transposition in July Part 2 includes proposed rules and guidance on areas that were not covered, or were only partially covered, in the first consultation and focused in particular on: The consultation closed in October HM Treasury consulted separately on legislative amendments to ensure that UK regulators have the powers necessary to implement the Directive.

The consultation closed on 15 February It is unclear when the outcome of this consultation will be published. This consultation proposed changes to the FSA rules and guidance relating to the operation of unit-linked and index-linked insurance policies primarily contained in COBS 21 to ensure consistency with the requirements of Solvency II. The feedback statement, published in June , confirmed the FSA's intention to make the proposed amendments to COBS 21 and addressed some general points raised by respondents.

The FSA began receiving submissions from those firms that are currently in the pre-application phase of the internal model approval process IMAP on 30 March Initially, the FSA had allocated submission slots to firms between 30 March and mid The FSA also confirmed that internal model applications should be based on the Level 2 text and proposed cross-referencing the text with its guidance materials. Areas of weakness identified included: The PRA stated that this was the most pragmatic way forward and allows firms more time to complete the work they need to do for their submissions.

EIOPA received over comments during the consultation period and issued final guidelines on 27 September The guidelines were addressed to National competent authorities NCAs which had to decide how best to implement the guidelines into their national regulatory or supervisory framework by the application date of 1 January The statement came into effect on 1 January and will cease to operate on the day prior to implementation of Solvency II, 1 January The statement explains that the PRA expects firms to have regard to the outcomes in the guidelines whilst also continuing to meet the existing PRA rules.

Whilst the guidelines are generally consistent with existing PRA handbook provisions, firms are required to implement the substantive provisions in order to ensure that they are ready for the new regime. The PRA sought to be proportionate in its application of the guidelines to ensure that there is a minimal risk of two regimes running concurrently. For each of the four areas of preparation the statement identifies where firms need to focus their efforts and where the guidelines require more than existing PRA handbook provisions.

The key issues are summarised below.

Solvency II

Disagreement on the treatment of long-term guarantees in times of market stress had stalled EU negotiations on the final Omnibus II text. EIOPA published the results of the LTG assessment which considered the following six regulatory measures aimed at ensuring an appropriate supervisory treatment of long-term guarantee products under volatile market conditions:.

Based on the outcome of the assessment, EIOPA supported subject to some minor amendments the inclusion of the extrapolation, classical matching adjustment, extension of the recovery period, and transitional measures. EIOPA also advised the trialogue parties to replace the CCP with a formulaic, more reliable measure, known as the 'volatility balancer'. EIOPA recommended excluding the extended matching adjustment altogether, whilst retaining the 'classical' matching adjustment.

Adams encouraged firms to reassess priorities and make a concerted push to ensure compliance. Firms will need to continue to meet existing regulatory requirements until Solvency II is implemented. Where possible, the PRA will look for ways that firms may be able to use their preparations for Solvency II to meet the current supervisory regime. It will play a key role in supporting the threshold condition that insurers must have appropriate non-financial resources and robust risk and capital management systems. The PRA thinks it reasonable to expect firms to be ready for Solvency II based reporting six months before implementation, meaning that firms falling within the thresholds should be able to submit their reports in July The PRA will continue to review the practicability of the reporting timetable but warns firms to prepare for higher quality reports and better synchronised reporting under Solvency II.

The first stage of the review looks at the approach and methodology used by firms, and the second stage will focus on the actual calculation of technical provisions. The PRA intends to publish information in the first quarter of on the progress of the first stage as well as an update on the second stage, which has been deferred as a result of Omnibus II delays. Now that the timetable is certain, firms must be prepared for their IMAP submission slots.

Capital add-ons - Article 37 of the Solvency II Directive prescribes the limited circumstances in which a capital add-on can be applied. Supervisors can apply a capital add-on where the risk profile is not in line with that in the SCR or there are significant governance deficiencies. The right is only supposed to be used in 'exceptional circumstances'. Once imposed a capital add-on is to be reviewed at least annually by the regulatory authority. If the deficiencies that led to its imposition have been remedied then the capital add-on is to be removed.

The method and process for calculating and imposing capital add-ons are expected to be set out in the Level 2 legislation and further explained in the Level 3 guidance. Individual members of the group must still comply with their own solo requirements but any surplus arising only at the group level for example, because of any diversification benefits may be treated as additional capital for the individual group members.

Understanding Solvency II

In addition, there are also capital instruments for example, hybrid capital and subordinated liabilities which will count towards the Solo SCR but not the Group SCR. Market consistent valuation - One of the fundamental changes in Solvency II is the move to a market consistent valuation of liabilities on the basis that your capital will never be assessed properly if you do not have a realistic view of your liabilities.

The market consistent balance sheet approach is similar to the fair value reporting approach used in international financial reporting standards. In broad terms this means that insurers should value their liabilities based on expected future cash flows, discounted appropriately and, unless they can find a hedge for their liabilities, insurers must hold a risk margin to reflect the cost of capital that would be required to transfer the liabilities to a third party. As part of this process there will also be new rules on how to treat reinsurance and other risk mitigation techniques.

Minimum capital requirements - Insurers will be required to satisfy a MCR and to run their business in such a way as to also satisfy a higher capital requirement, the SCR. The SCR will be calculated using either a standard formula or a bespoke internal model, or in some circumstances, a partial internal model together with the other components of the standard formula.

The risks to be covered by modules of the model include underwriting risk, market risk, credit risk and operational risk. Internal models will need to be used to manage the business and approved by the relevant supervisor. This is likely to require documentation of a high standard which enables the model to be properly understood. Internal models will not, however, be subject to a separate external audit. The main purpose of the ORSA is to ensure that a firm engages in the process of assessing all the risks inherent in its business and determines its corresponding capital needs.

Capital held is known as 'own funds' and Articles 88 to 90 and 93 to 98 of the Directive prescribe how these are to be determined and classified. Own funds can either be basic own funds what an insurer has on the balance sheet, for example, the excess of assets over liabilities plus subordinated liabilities or ancillary own funds what an insurer may be able to call upon if needed, for example, unpaid capital, letters of credit, guarantees and other legally binding commitments.

Ancillary own funds can only be used as capital with the approval of the supervisor.