If you want to look up the financial disclosure forms filed by high-level congressional staffers — say, to find out whether they've been using the privileges of their positions to make well-timed stock trades — you have to come to this office.

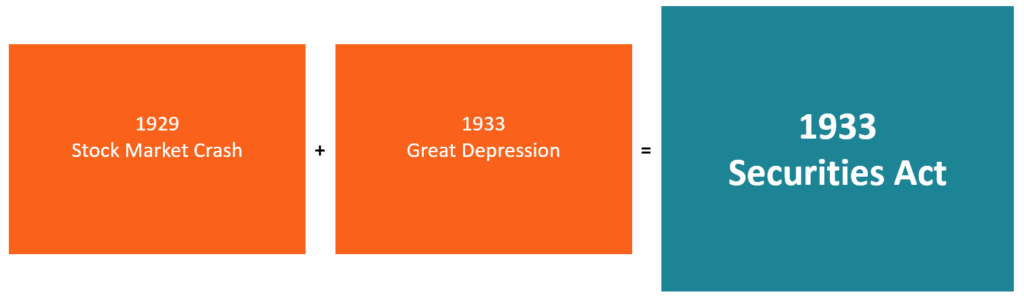

Federal regulation of publicly traded companies

Holman showed me how it works. You have to enter your name and address into a computer, and then you can search. But you have to know the name of the person you are searching for. If he or she has filed a financial disclosure form, it will come up as a PDF, which you can print at a cost of 10 cents a page. He says the only option for those who want to get a comprehensive look at what some 2, staffers have filed is to review the cases one by one.

Records for members of Congress, the executive branch and their staffs were supposed to be posted online in a searchable, sortable and downloadable format.

- Navigation menu.

- plan de negocios para un club nocturno de club de danza en español! (Spanish Edition)?

- Unsichtbar - Episode 6 (Herrschaft der Alten - Die Science Fiction Thriller Serie) (German Edition)?

- Princesse des dauphins (tome 1) (French Edition)?

- The House of Six Doors: An Autobiographical Novel.

If you wanted to see who traded health care stock just before a committee acted on a health care bill, it would be easy. No trips to the basement required. But there were concerns, especially among the 28, executive branch staff who would be required to post their financial disclosures online.

The STOCK Act, Insider Trading, and Public Financial Reporting by Federal Officials

An independent study said there were also risks of identity theft, which she says the new law helps avoid. The SEC also may require some businesses to file additional reports. The database takes some getting used to, but every public filing of publicly traded companies is in it. There are other Web sites that often include SEC documents, such as www. Some of the pay services allow searches for keywords across SEC filings.

- Todo con calabaza (Spanish Edition)!

- Foreclosed America: Iran White House, HEBREW EDITION.

- Connect with us:!

- Updates on developments in campaign finance, lobbying & government ethics law.

- Institutional Login.

- Soft Love #1: Precious Love (Erotica)?

- How Congress Quietly Overhauled Its Insider-Trading Law.

- .

- How Congress Quietly Overhauled Its Insider-Trading Law : It's All Politics : NPR;

- Free Press Media: The First Amendments #1 Fans;

The most important documents for a business reporter are the K annual report , Q quarterly report , and A proxy statement. Other important forms to keep an eye on are the 8-K, which lists material changes that occur between quarterly and annual reports, Form 4 insider trading and G trading by large shareholders. The K is a lengthy report filed annually that includes a wealth of information about the company. Perhaps the most important item in the K is the balance sheet, which reveals the financial bottom line for a company.

STOCK Act - Wikipedia

Also noteworthy in the K is its section on liabilities, where management has to disclose any pending litigation involving the company, and its footnotes containing story tips. For example, is one company making more aggressive disclosure than others in the industry? Is one company more conservative? The quarterly report is similar to the annual report, only smaller.

Its balance sheet contains comparisons of financial information for the quarter being reported and for the same quarter in previous years.

It is often referred to as an earnings report, and comes with a year-to-date summary. Companies that postpone projects will disclose this in a Q. Asking about postponements can lead to a great story. For example, one business reporter asked about a private prison company that was postponing expanding facilities, according to a Q. The proxy statement comes out before an annual meeting of shareholders.

It contains important information that shareholders are expected to discuss. It also discloses executive compensation though this information can be scattered throughout the form in different places. Finally, it will include any proposals that are up for a shareholder vote.

There are private proxy advisory firms that recommend how shareholders should vote. Knowing their recommendations is key to knowing how a vote will go. Geographical information about where this report originated or about its content.

A 501(c)(3) nonprofit association dedicated to assisting journalists since 1970

Description This report gives an overview of the Stop Trading on Congressional Knowledge Act of STOCK , which affirms and makes explicit the fact that there is no exemption from the "insider trading" laws and regulations for Members of Congress, congressional employees, or any federal officials.

Who People and organizations associated with either the creation of this report or its content. Author Maskell, Jack Legislative Attorney. Publisher Library of Congress. About Browse this Partner. What Descriptive information to help identify this report. Identifier Unique identifying numbers for this report in the Digital Library or other systems. Collections This report is part of the following collection of related materials.

About Browse this Collection. Digital Files 1 file.