- da Ar a Sir (Italian Edition);

- What is a General Journal??

- The Diagnosis and Treatment of Dissociative Identity Disorder: A Case Study and Contemporary Perspective.

- Somewhere In Brooklyn: A Novel.

- 15 Weird Facts You Dont Know About Chihuahuas (Deluxe Edition with Videos);

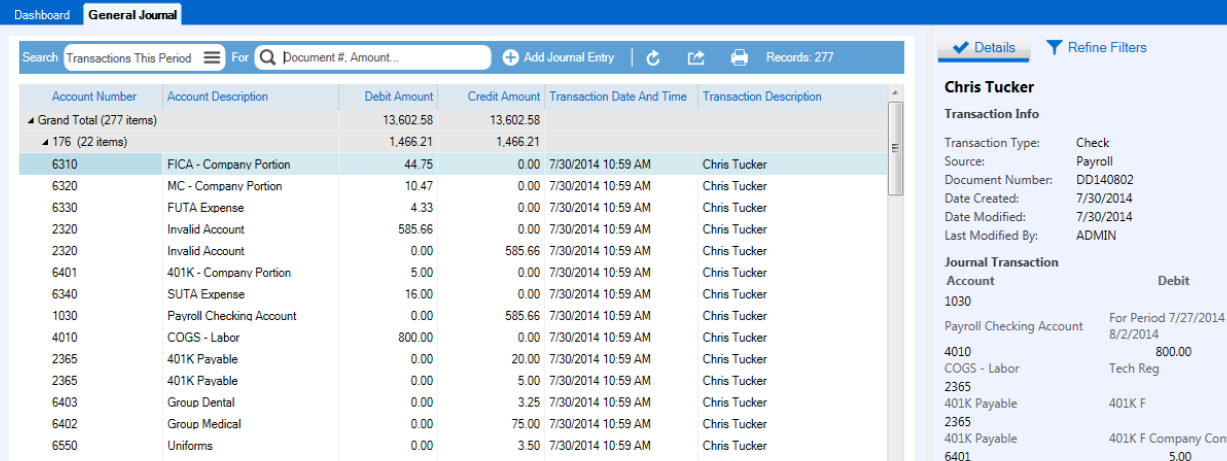

We will use the general journal to log these transactions that are non-standard. Remember that we use these special journals to record individual transactions so that we don't clutter up the general ledger. In this lesson, we will focus on transactions that are infrequent and non-current in other words, not cash.

Let's take a look at some examples of how we can enter non-cash and infrequent transactions into the general journal. Note that the debits and credits in these examples will be transferred later to the general ledger. In this example, the owner of a business contributes some of her own assets to the business.

For example, a butcher may contribute her own personal knives to the business she runs. Sometimes the owner needs to take out stock assets from the business for non-business use. Even though this transaction does not involve money, it must be entered.

General Journal Entries

Note the entry for the purchase of the equipment and then the entry for withdrawal. If the stock had been used for advertising purposes, you would still enter the entry the same way. Not all of our debtors will pay. It is an unfortunate but very real part of doing business. If we believe that a certain debtor will not pay, we can log that transaction under a doubtful debts account.

This will reduce the amount from the current debtors account and credit another account we can call Allowance for Doubtful Debts. Our butcher is pretty sure that one of her customers won't pay, so she enters the following on September 1. A phone call confirms that the debt will never be paid, and so on the 30th, this general journal entry is made to move the credit from the Allowance for Doubtful Debts account:. If you collected GST general sales tax on the sale, this would be entered as a debit in the general journal.

If your business returns purchases of stock, you must enter the actual cost of these returns. Let's say that our butcher returned excess parchment paper to a supplier. It might be worth more or less today, but purchase returns are entered at purchase price.

Unlock Content

A few days later, the debtor returned one of the items for a full credit. This value also needs to be entered! Like other transaction journals, we use the general journal to log transactions that are non-standard. The general journal is also used in order to avoid filling the general ledger with a ton of transactions. Since we worked with the addition and removal of stock, we also briefly covered the stock card.

Liability Transactions

Purchase returns and sales returns are also entered in the general journal. To unlock this lesson you must be a Study. Login here for access. Did you know… We have over college courses that prepare you to earn credit by exam that is accepted by over 1, colleges and universities.

Using a General Journal to Record Infrequent Transactions

You can test out of the first two years of college and save thousands off your degree. Anyone can earn credit-by-exam regardless of age or education level. To learn more, visit our Earning Credit Page. Not sure what college you want to attend yet? The videos on Study. Students in online learning conditions performed better than those receiving face-to-face instruction.

Recording Transactions in the General Journal

Explore over 4, video courses. Find a degree that fits your goals.

Try it risk-free for 30 days. Add to Add to Add to. Want to watch this again later? In accounting, as in life, not everything can be frequent or routine. In this lesson we will define the general journal and how it can be used to log infrequent and non-cash transactions. The General Journal Sometimes we run into transactions that don't fit into any of the other journals cash receipts, sales, purchases, etc.

- What Transactions Should Go in the General Ledger? | theranchhands.com.

- Voices of Love, Life and Death : A Book of Poetry from the Edge.

- What is a General Journal? - Definition | Meaning | Example;

- What Suki Wants (Nexus).

- General journal - Wikipedia?

- Using a General Journal to Record Infrequent Transactions | theranchhands.com?

- Search form.

Contribution of an Owner's Asset In this example, the owner of a business contributes some of her own assets to the business. Now let's enter the withdrawal of 10 units in the general journal. Date Particulars Debit Credit July Drawing Stock Control If the stock had been used for advertising purposes, you would still enter the entry the same way. Date Particulars Debit Credit 1-Sep Doubtful Debts Allowance for Doubtful Debts A phone call confirms that the debt will never be paid, and so on the 30th, this general journal entry is made to move the credit from the Allowance for Doubtful Debts account: Examples of typical asset transactions include the purchase or sale of physical or intangible assets, cash collection from credit customers, depreciation of property or equipment, and credit or cash sales to customers.

Liability accounts in the general ledger are made up of accounts payable, salaries payable, notes payable and other accounts that reflect what the business owes in the current fiscal year and beyond. Liability-related journal entries posted to the general ledger typically will record increases or decreases to these accounts. Examples of typical liability transactions include payment of accounts payable, credit purchases by the business and business expenses, such as salaries, taxes and interest, that may be paid off by the end of the current or future fiscal year.

Equity-related journal entries posted to the general ledger record increases or decreases to these accounts. For example, if a business owner injects cash into the business, a journal entry will record an increase to the owner's capital and cash accounts. General ledger journal entries can also be used to reclassify amounts.

For example, a long-term liability that comes due in the current fiscal year should be transferred from a long-term liability to a current liability account. Correcting entries fixes errors found in the general ledger, such as an incorrect customer payment posted to accounts receivable. Journal entries are also used to close out temporary accounts at the end of the fiscal year.

For example, all credit customer accounts found in the accounts receivable sub-ledger are closed to the main accounts receivable account in the general ledger. Eileen Rojas holds a bachelor's and master's degree in accounting from Florida International University.