In the UK, bank rates e.

Interest rates: What the rise means for you

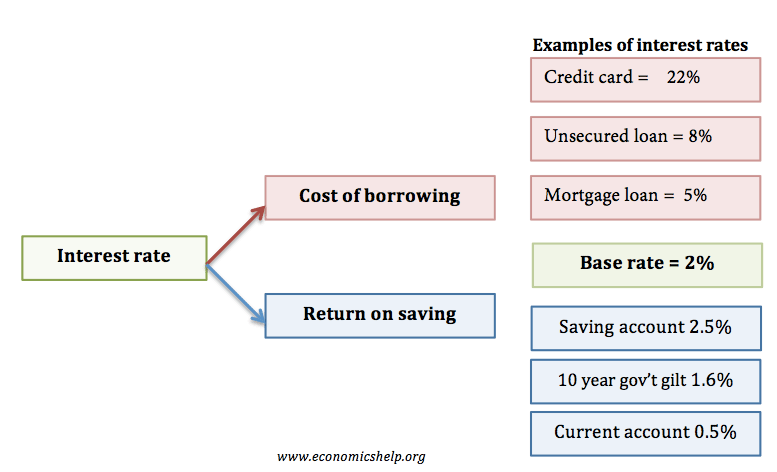

After the impact of the credit crunch diminished the UK saw a fall in Libor rates, and bank rates came closer to base rates. Real interest rates measure the interest rate — inflation rate. Savers are increasing their real wealth. However, if we have negative interest rates, interest rates of 0.

In , the saving ratio rose sharply — despite a cut in interest rates. Higher interest rates also make it more attractive to save money in the UK, as opposed to other countries. In India there is no social security.

Those who do not get pension it is their only income and if Govt snatch that amount it is tantamount to push them to slow death. Here economic argument does not hold good, take it as a social duty, duty to your old father. Your email address will not be published. Leave this field empty. An increase in interest rates will make saving more attractive and should encourage saving.

Accessibility links

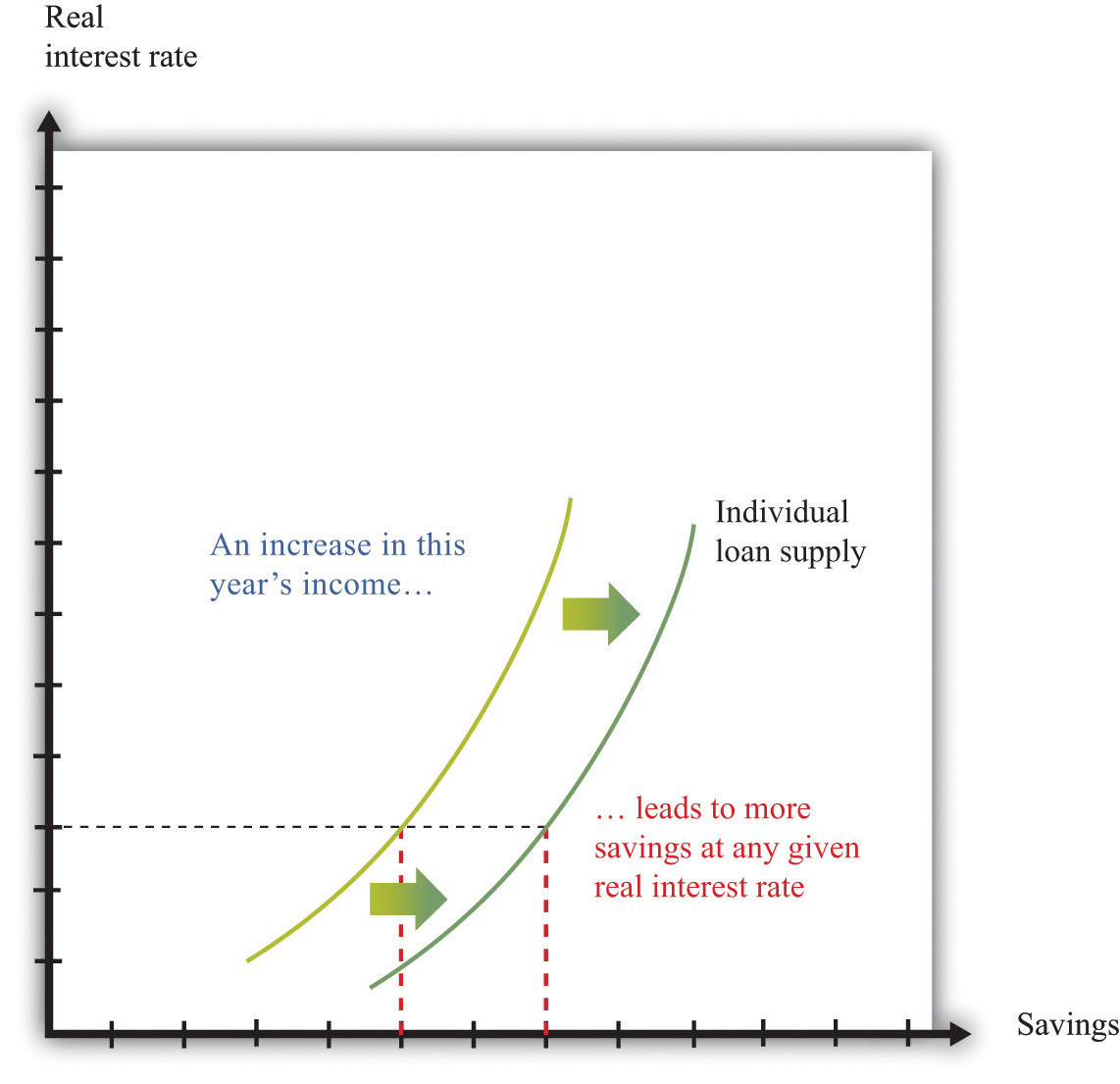

A cut in interest rates will reduce the rewards of saving and will tend to discourage saving. The fear of unemployment and recession was greater than the effect of lower interest rates Income and substitution effect of higher interest rates. If interest rates fall, the reward from saving falls. This is the substitution effect — with lower interest rates, consumers substitute saving for spending.

However, if interest rates fall, savers see a decline in income because they receive lower income payments. A pensioner relying on interest payments from saving may feel he needs to save more to maintain their target income from savings. This is just an example of how to build a savings portfolio, not a recommendation as to what to do with your cash. You should always make decisions based on your personal circumstances.

So for most people, we think a good approach is to have a mixture of investments and savings, to get the right balance of a guaranteed rate of return and the potential for higher returns.

- Systematic Theology.

- How Banks Set Savings Account Rates!

- BBC News Navigation.

Read about our cash savings service — Active Savings. Home News Articles What does the interest rate rise mean for your savings? Archived article Tax, investments and pension rules can change over time so the information below may not be current.

What does the interest rate rise mean for your savings? | Hargreaves Lansdown

What does the interest rate rise mean for your savings? Joel Lewis 31 August No news or research item is a personal recommendation to deal.

The Bank of England on Thursday raised its base rate for only the second time in a decade, inching it up from 0. What impact will it have on your mortgage, savings and the property market?

NDTV Beeps - your daily newsletter

The direct impact on most people is minimal. Most people with large mortgages are on fixed rates, so the increase has zero impact. If you are on a tracker mortgage that matches any rise in the base rate, then an extra 0. Banks tend to push through rate rises on mortgages immediately but are much slower to raise savings rates. The most that savers are likely to see is increases to 0. Possibly but the tone from the Bank of England governor suggests the next rate rise might not be until at the earliest.