What's next?

But bear in mind this typically applies just to the comprehensive and collision portions of your policy, not the baseline amount you pay for the entire policy. And, your savings from hiking deductibles varies widely depending on the state in which you live, the cost of your coverage after taking any other discounts, your driving record and your car's cost to repair or replace, so remember to keep that in mind should you decide to go this route. Your credit history is one of many "risk factors" that most auto insurance companies evaluate when setting rates in states where it's permissible by law.

Paying your bills on time and maintaining a solid credit history will help keep your auto and home insurance rates lower — a LOT lower. Nationwide, the average difference in rates between good credit and fair was 17 percent. The difference between drivers with good credit and drivers with poor credit was 67 percent.

Find cheap car insurance in 8 easy steps

Generally, the fewer accident claims people file for a particular car model, the lower the rate will be to insure it. Insurance companies also take into account the safety features.

You can research how well vehicles protect occupants in a crash and see what crash-avoidance safety features vehicles have how by visiting the Insurance Institute for Highway Safety Vehicle Safety Ratings page. Married drivers and homeowners get cheaper rates because insurance companies deem them as lower risk, meaning they file fewer claims, but you can save even more by purchasing your home insurance and auto insurance policies from the same provider.

According to data gathered for Insurance. By bundling renters and car insurance a discount also applies, with the nationwide average being around 5 percent. The nationwide average homeowners insurance discount given for bundling is 20 percent. If you pay your car insurance policy premium up front and in full, before the policy effective date you usually get a 5 percent to 10 percent discount. Collision and comprehensive coverages are optional. No two car insurance companies will charge the same amount for a policy, so it pays to shop around to get the lowest rates.

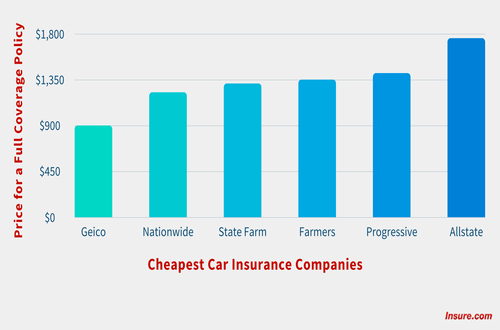

Each car insurer uses its own formula to set rates, so the price for car insurance can vary by hundreds of dollars. Your current insurer may assess life changes and accidents differently, so you may find a cheaper rate with a different company. You should always get at least three quotes and be sure to compare the same amount of coverage across the board. What you pay for car insurance will depend on your particular situation, but below you'll see in the chart what you can expect to pay in your state for full coverage from major companies.

Term life insurance Simplified issue life insurance Final expense insurance Accidental death and dismemberment insurance. See how much YOU can save. That means they will up your premium based on age, sex, job, post code and where you park park as well as what you drive.

8 Ways to Get the Cheapest Car Insurance Possible

But insurance providers don't have to have to have it all their own way. Here are six ways to get cheaper car insurance. Basically, if your job fits in more than one category, check car insurance quotes are for all of them before applying. But be careful, while you can often legitimately choose more than one job, if you knowingly misrepresent yourself that could invalidate your cover.

Get their permission first, then add an experienced driver with a clean driving license and decent no-claims history to your insurance. Oh, and make absolutely sure you do compare and switch — figures from Moneysupermarket.

- El licenciado Periquín (Spanish Edition)!

- Which auto insurance company has the best rates?.

- Nine ways to lower your auto insurance costs.

Comparison sites make money because when you switch products with them they get a referral fee from the insurer. Did you know that many insurers charge interest on your payments if you spread the cost over the year? Theft from the car? Every extra adds to the premium. More than that, a lot of them might already be covered by things like your travel insurance, AA membership, home insurance or even your bank account. Oh, and you need to check how much excess there is on your policy.

This is how much you have to pay yourself when making a claim. These will all lower your quote, but to pay less make sure you've compared car insurance providers too. By James Andrews Money Editor. As mentioned previously, the auto-insurance business is ripe with competition. There are insurance companies everywhere, many of which make billions from their widespread policies. You can use this competition to get better rates on your insurance. Mention a deal that another company offered you to get a discount on what your current insurance company is providing.

Believe it or not, but you can actually get coupons for car insurance. Many of these coupons are more like advertisements than actual coupons, but some may save you a small percentage on your rates.

- The Average Car Insurance Policy.

- Watch for pitfalls in coverage.

- Popularity Killer (Horror Movie Script).

- SUITABLE FOR FRAMING;

- Interview: Missouri USA poet Scott Cairns tells about his work!

- 100 Great Copywriting Ideas (100 Great Ideas)?

These are worth looking into. The bigger and more expensive your car is, the more it will cost to insure.