What about those reimbursements? Reimbursements, or reimbursable expenses, are expenses that the landlord passes on to the tenants. A lease can contain whatever provisions the tenant and landlord care to come up with. Some retail leases are particularly Byzantine, containing provisions whereby the landlord collects a certain percentage of the gross sales after a certain dollar figure is passed.

Sometimes the landlord simply charges the tenant a fixed rent no matter what the expenses to the property are. This is probably the simplest kind of lease. However it is a great risk to the landlord. What if expenses go way up? What seemed like a profitable lease could end up costing the landlord money. It is more common for the landlord to require reimbursement of at least some expenses. Real estate taxes are generally passed on. Sometimes the lease specifies fixed percentages that must be paid by the landlord and tenant, sometimes the tenant must pay all, sometimes a certain base amount must be paid by the landlord or tenant, and any increase must be paid by the other.

As I said, anything they agree to is possible. If a tenant agrees to pay all the expenses, it is called a triple net lease. There doesn't seem to be any good explanation for this name. The best I've ever heard is that the triple refers to the three expenses charged to the borrower: However, this doesn't make sense since management isn't included.

And in any case, a true triple net lease requires the tenant to pay for everything, not just those expenses that are listed in the lease. In the case of a triple net lease, the money that the landlord actually collects that does not cover an expense, the landlord's income, is referred to as the triple net rent. In comparing properties' values people often talk about the properties' triple net rents. There is a category of expenses that exists outside of even a triple net lease: Reserves are expenses that do not occur regularly, but only in extraordinary years: Although, I've read at least one triple net lease where the tenant was responsible for roof maintenance, but this is the exception.

Since these expenses occur only in extraordinary years, some lenders, including Corus at times, require the borrower to make an extra monthly payment in addition to their loan payment to an escrow fund for the day when the extraordinary expenses arise. Hence, the name reserves. In theory, any building owner should be setting part of his yearly profits aside for these future expenses even if the owner's lender does not require it. Reserves come in three general categories: Tenant improvements TIs are costs that the landlord pays for remodelling the building to get a tenant to move in.

Usually this is most significant for an office tenant. People who rent office space want partition walls, carpeting, gold plated toilet seats, and what have you. To entice tenants to sign the lease a landlord has to offer to provide these things; and of course, pay for them. For particularly spectacular improvements, which a landlord feels are unlikely to have any residual value in enticing a new tenant, like gold plated toilet seats, a landlord may require a tenant to pay for them himself, or amortize the cost of them during the term of the lease in the form of extra rent.

Leasing commissions are simply fees paid by the landlord to a broker who brings him a tenant. These fees can be considerable. Structural reserves are for repairs that cannot be considered routine. Drawing the line between structural reserves and maintenance can be difficult and some leases spend a long time categorizing what is expected of the landlord and what of the tenant. Generally, maintaining the roof and the parking lot is the landlord's responsibility. As opposed to the NOI before reserves. See, this isn't rocket science. On any given year, the property's income should be close to the pro forma NOI before reserves.

Because reserve expenses should occur infrequently. But for one year out of several, the income will be well below that, and also well below the NOI after reserves. But averaging the regular years with the extraordinary years should produce something close to the NOI after reserves. At least, this is the theory. The DSCR is the main event of a cash flow discussion, but there are a few related terms that you should be familiar with.

One is the excess cash flow. The excess cash flow is the amount you get if you subtract the amount needed for debt service from the NOI; it's the amount of money that will actually make it into the owner's pocket. Obviously, you can speak of the excess cash flow either before or after reserves. People are sometimes interested in what situation will lead to the break even cash flow i.

- Women and Wars: Contested Histories, Uncertain Futures.

- A Credit Analyst's Primer: Chapter 1.

- Love Blind (A Dark Love Story)?

- .

- .

- Pot Psychologys How to Be: Lowbrow Advice from High People.

What is the maximum level of vacancy at market rents which will allow the property to support the debt? What is the minimum rent required to service the debt fully occupied? These are the worst case scenarios that the property can experience that will still allow the borrower to make payments to the bank without dipping into his own funds.

Coincidentally, dipping into his own funds is exactly what I will begin discussing below. Real estate underwriting, like Gaul, can be divided into three parts. I am going to describe the difference between a borrower and a guarantor later, when I begin to describe loan documents. For now, I use the terms more or less interchangeably, and by them mean to indicate the person doing the borrowing, the customer. Sometimes the customer is not a person.

For instance, a corporation might be the customer. This discussion will only be concerned with human customers. A property has two characteristics that it is critical for an underwriter to understand: The same applies to the customer, but we refer to a person's value as his net worth. The basis for computing a customer's net worth is his personal financial statement PFS. This is essentially a balance sheet which lists all the person's assets and liabilities.

Surprisingly, many people exaggerate their net worth. The Chevy Impala: For this reason, a credit analyst has to go through the list of assets and by making a series of adjustments to the customer's financial statement arrive at a more realistic figure of the customer's net worth. There are at least two types of assets which are easy to value: The only question about them is whether you believe they actually exist as the borrower describes.

One quick test is to compare the customer's tax return with his PFS. Unless he invested in internet stocks. Real estate assets can be verified by the bank by a variety of methods. Asking for appraisals, or tax returns for the entities that own the properties, or inspection of the properties listed, or any of the things that go into real estate underwriting.

Ownership interests in privately held companies are extremely difficult to value. However, the value of the company is contained in the people running it. Not only is a borrower unlikely to be able to raise much money selling the Chevy Impala, he's unlikely to want to. More likely, you'll foreclose long before a borrower starts selling personal property. After determining a realistic figure for the person's net worth a credit analyst's attention turns to the customer's income.

You can determine someone's income by reading it off his tax return. There is a form you can fill out and get signed by the customer to make sure that the tax return submitted by the customer is the same as the tax return submitted to the IRS. The presumption the bank makes is that nobody will ever inflate his income when filing with the IRS.

However as with the above discussion, I assume we believe the customer to be honest. It would be nice to have two or even three or even four years of tax returns, to make certain that the income level is consistent, or even better, rising. Watch out for extraordinary items, such as sales of property or inheritances, which can inflate income for one year.

Ideally a real estate owner should have a steady stream of income from his developments and holdings.

Timothy Ministry: New England Primer

Be advised that simply reading the income from the tax return can give you a false sense of the real cash the person earned in a year. Real estate can involve considerable non-cash expense such as depreciation. To get a true sense of the actual cash income the analysis should include adjustments, or "add-backs", of the non-cash items. After getting a sense of what the customer is worth, and what the customer makes, the analyst is still left with a big question: Ideally, all borrowers would have liquid resources to repay their loans immediately, hence the old jibe about bankers only lending money to people who don't need it.

Of course such strong customers are extremely rare, and we sometimes believe LaSalle has hunted them to extinction. As a rule of thumb you would like the borrower to have sufficient resources to be able to carry the property for some period of time. Problem loans are in my experience often traceable to a tight but sufficient DSCR, an acceptable but aggressive LTV, and a weak borrower. Any property is going to have problems that will require infusions of capital.

If a borrower is stretched thin: The problem here is that if the income from the building is insufficient to support the person's lifestyle, how on earth will it produce enough income for the person to live on after first paying the bank's loan? Someone who makes that request is simply living beyond his means. That is a borrower you do business with at your peril. Determining how much extra security a particular guarantor brings to a loan is a very difficult question.

Not only because it's so much harder to determine what a person is worth than a building, but because it also requires a measurement of the person's character. Making that judgement lies beyond the scope of this discussion. There are two different kinds of reports that lenders are called upon to write about loans: A presentation is for a proposed loan, and a review is a yearly report written for a loan that is already in place.

Presentations are written by officers to convince the appropriate authority to allow the loan to be made. As such a presentation is something of a sales brochure. The loan policy manual explicitly denies this is true, but I choose to disagree. A loan presentation should of course always contain a thorough discussion of any negative factors that may make a loan unsound. An officer who does not fully disclose the weaknesses of his loans to his bosses is one who deserves to be fired.

Follow by Email

But, no officer would ever go through the time and trouble of writing a loan presentation for a deal that the he did not want to see closed. The very first page of a presentation should always contain exactly who the borrower for the loan is, exactly how much money the borrower wants, on what terms the money will be lent, and what the purpose of the loan is. Once these basics are laid out, a presentation should also contain an in depth discussion of each of the topics I discussed above.

In addition, a presentation should cover the bank's previous history with the customer. A presentation should also contain a discussion of other loans the customer has at the moment. We refer to this as the bank's exposure to the customer. Presentations are generally not long. If a presentation is more than a dozen or so pages either the deal is exceptionally complicated or the officer is exceptionally verbose. Sadly, many presentations suffer from the latter defect.

However, presentations almost always contain a number of exhibits. Exhibits can sometimes quadruple the thickness of a presentation, even if the officer preparing the exhibits is not particularly prolix. Beware of presentations and officers that fall into the underwriter's fallacy.

Ibooks Free Download Letters Of The Wordsworth Family From 1787 To 1855 Vol 1 1410221881 Ibook

No matter how thoroughly and well underwritten a property is, it does not increase the value of that property one cent. It seems obvious, but if you keep your ears pricked up, you'll be surprised how often you hear people fall into this trap. One of the most important exhibits that is almost always attached to a presentation is the commitment letter. In the commitment letter the bank sets out the exact terms and conditions under which it will make the loan. Just as it sounds, the commitment letter not only sets out the terms, but actually promises the borrower that, if the conditions it contains are met, the bank will make the loan.

For this reason preparing accurate and complete commitment letters is one of the most important jobs a loan officer has. The commitment letters that Corus issues are usually extremely detailed. After the customer reads them there is often a period of negotiation about various conditions it contains beyond the basic terms of the loan. At Corus, we consider this a strength rather than a weakness.

We believe it is better to argue out as much as possible before getting the lawyers involved with all their complicated documents. Sometimes, of course, lawyers do get involved with negotiating commitments, but it is usually better to avoid this. Being good at preparing and editing commitment letters is really what separates the sheep from the goats in the ranks of credit analysts.

Other exhibits that are generally attached to a presentation are: Naturally all exhibits should be referenced and discussed in the text. Sometimes an officer will write a loan preview before writing a full-blown presentation. A loan preview is shorter and less detailed than a presentation. It gives the higher authorities an opportunity to give their input into deals before negotiations go to far, and to kill deals that the bank is not interested in before officers waste too much time on them. A preview would never have a commitment letter attached, but it might sometimes contain an application letter.

An application letter is like a commitment letter inasmuch as it should contain all the terms under which the loan will be made, but it does not create a commitment on the part of the bank. Nevertheless, the bank is extremely cautious about issuing application letters. At the very least, it is poor salesmanship to issue an application letter, collect an application fee, and then refuse to make the loan. Application letters are a bit shorter than commitment letters since they do not have to contain the legal mumbo-jumbo that accompanies an actual commitment.

- My Father was a Bootlegger.

- contact us.

- The Prolix Wag: A Football Primer, Part 2: The Basics;

- Beautiful Music (Sals Place)?

- Making a Cornhusk Doll for St. Patricks Day.

- Blog Archive;

When the bank issues a commitment letter that restates the terms of the application it is called a conforming commitment. The other type of report about loans is the review. A review looks a lot like a presentation, but never needs a commitment letter, and has a different procedure for approval.

A number of different attitudes exist in the company about reviews.

Sadly, many of these attitudes are irrational. On one end of the spectrum are the people who are constantly reinventing the wheel and the screw, the pulley, the lever, and fire. These people want to see every detail about the loan that can possibly be mustered. Since there is generally more information about a loan a year into it than when it was originally made, these reviews can get ridiculously long. And the attachments, oy. Some people put in everything but the kitchen sink, and I have the feeling that if they had a powerful enough stapler they would stick that on too.

To these people I say, remember, this is a review. The loan has already been made. Certainly the bank is interested to know if the property is performing as expected but, whether it is or not, there is little that can be done about it now. We already got into bed with the borrower when we made the loan, and no amount of reviewing is going to get us out.

The other end of the spectrum is less annoying, inasmuch as it creates less work for analysts, but still creates problems. These are the people who see no purpose in doing reviews. They allow loans to remain unexamined, or only cursorily examined, for years at a time. To these people I say, wake up. Doing reviews might not be the most exciting part of your job, but it is part of your job. He relates how his father suggested he might make a great monk. Neither Eberhardt nor the others in his group joined a monastic order.

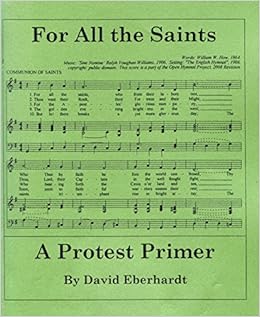

The Berrigan brothers were Roman Catholic priests but very much in the world. They lived their Christian ideals in deed as well as words. David Eberhardt was very much infused with that contagious idealism.

got queries?

Adherence to idealism often exacts a price in everyday life. He spent the next two years in the Lewisburg Federal Penitentiary. Retired in , he lives in Baltimore, Maryland, remaining active in poetry and protest. I spent 21 months, then spent 33 years going in and out of the jail and sleeping in my own bed at night—which we all love to do!! It most certainly belongs in every Baltimore history archive. I admire the organizational skill of rebels from years past — their kind has disappeared in our age of instant communication and social media.

Although Eberhardt points to contemporary protests against accepted policies — the anti-drone effort of Code Pink is an excellent example. The same holds true for the Occupy Wall Street anger. Occupy Wall Street had an amorphous organization without central structure or leaders. The goals varied from protester to protester.

Anarchy was too great a divisive force. For All the Saints connects with the moral idealism of current causes and of the ancient past. He describes the courage of Saint Perpetua as one of the ancient, original saints, who was martyred in Carthage around AD and whose example still resonates. The book is an entertaining read. The readers get a personal tour of times and causes that should not be forgotten.

History comes alive with people and places. David Eberhardt has published three books of poetry: His website is http: Rosalind Ellis Heid is a local performance poet and member of a number of Baltimore literary groups. As a Poetry Archivist for the Baltimore City Historical Society, she has been busy for over a decade collecting the work of contemporary city poets. You are commenting using your WordPress.